Global Crackdown on Foreign Property Buyers: Why Dubai Stands Out as the Last True Haven

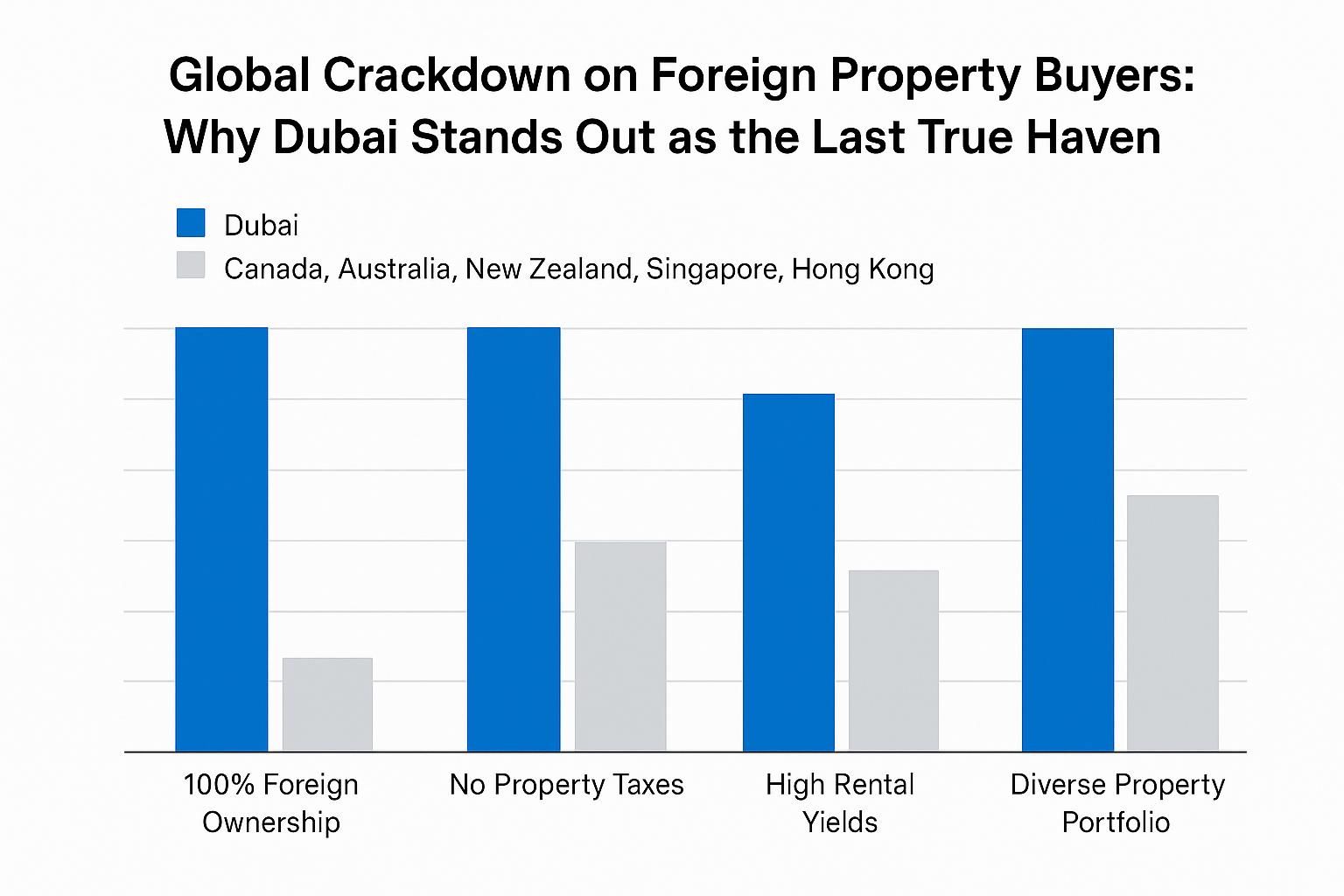

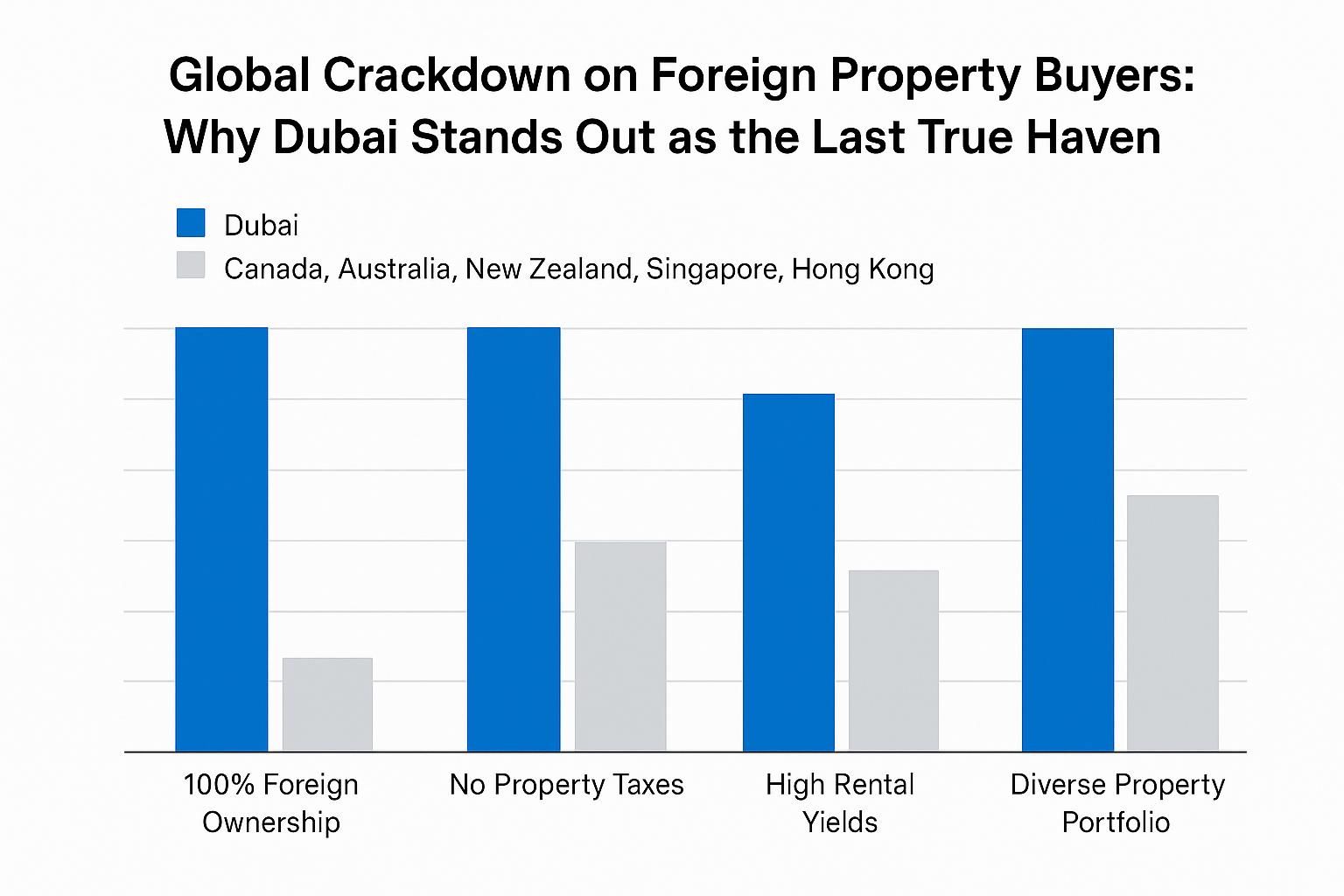

In recent years, a wave of restrictions targeting foreign property buyers has emerged across several countries. Governments in places like Canada, Australia, and New Zealand have imposed strict regulations to curb overseas ownership, citing reasons ranging from housing affordability to national security. Amidst this growing global crackdown, Dubai has solidified its position as a welcoming and lucrative destination for international investors.

Dubai, with its zero property tax, streamlined ownership procedures, and stable economic environment, has proven to be a true haven for those seeking high-return real estate opportunities without bureaucratic entanglement.

In 2023, Canada implemented a two-year ban on foreign homebuyers in an attempt to cool its overheated housing market. Non-residents found themselves shut out from one of the world’s most in-demand real estate markets, severely impacting investor sentiment.

Australia requires foreigners to obtain prior approval from the Foreign Investment Review Board (FIRB) and imposes hefty surcharges and taxes. In some regions, the stamp duty for foreign buyers is nearly double that of local residents.

Since 2018, New Zealand has prohibited most non-residents from purchasing existing homes, citing affordability concerns. This policy has dramatically reduced international participation, making the real estate sector increasingly insular.

Singapore and Hong Kong both levy Additional Buyer’s Stamp Duties (ABSD) on foreigners. These levies can climb as high as 60% of the purchase price in some cases, creating substantial barriers to entry.

Unlike many global markets, Dubai allows 100% freehold ownership in designated zones for foreigners. Investors from any nationality can buy, sell, lease, and inherit property without any additional restrictions, making it an unparalleled choice for global buyers.

One of Dubai’s most attractive incentives is its zero-tax policy on property ownership. There are:

This tax-free environment enables investors to maximize their rental yields and resale profits without losing margins to government levies.

Dubai consistently offers one of the highest rental yields globally, averaging between 6% to 9%, depending on location and property type. Compared to cities like London (2–3%) or New York (2–4%), Dubai presents a far more lucrative investment.

Dubai offers a wide range of real estate options, including:

This diverse portfolio allows both first-time buyers and seasoned investors to find properties that align with their budgets and investment goals.

Dubai has taken strong strides to ensure transparency and investor confidence, including:

This legal infrastructure fosters a safe and secure environment for foreign buyers, shielding them from common real estate pitfalls found in other markets.

Dubai is known for its cutting-edge infrastructure, including:

This makes the city a magnet for global talent, entrepreneurs, and high-net-worth individuals seeking both business and lifestyle advantages.

Dubai offers residency visas to property investors, with options such as:

These long-term visas are a major draw for foreign investors, offering a stable legal presence and access to the UAE’s global business ecosystem.

Dubai consistently ranks among the safest cities in the world, boasting an ultra-low crime rate, and a multicultural society where over 200 nationalities coexist. The tax-free personal income policy enhances Dubai’s appeal to professionals and investors alike.

With Expo 2020’s long-term impact, the Dubai 2040 Urban Master Plan, and a continued focus on sustainable, tech-driven development, Dubai’s property market is poised for continued growth. As more global cities introduce restrictive policies, the relative openness of Dubai’s market will drive more foreign capital into the emirate.

Additionally, with a young, fast-growing population, strategic location between Europe, Asia, and Africa, and strong government backing of real estate infrastructure, Dubai is future-proofing its property sector.

While other nations close their doors to foreign property buyers, Dubai rolls out the red carpet. With 100% foreign ownership, no taxes, high rental yields, and investor-friendly laws, Dubai is not just surviving the global crackdown — it’s thriving.

For those seeking security, profitability, and long-term value, Dubai stands out as the last true haven for international real estate investment.